Mortgage Rates Are Going Up, What Does This Mean for Spring 2022 Homebuyers?

Mortgage Rates Are Going Up, What Does This Mean for Spring 2022 Homebuyers?

After two years of incredibly low rates, the average mortgage rate is now the highest it's been since May 2019, i.e pre-pandemic. As we re-enter normalcy again, homeowners now face the challenge of the rising cost of borrowing, appreciating house prices, and economic inflation.

Yes, I know it sounds scary. I know you may be questioning whether or not now is the time to buy. Don't worry, our team is here to give you the confidence to enter the homebuying game with strength, and most importantly, knowledge.

Here's the truth: rising mortgage rates do not always necessarily mean less buying power, and it certainly doesn't mean you should stay on the sidelines this spring if you're looking to buy a home.

The market is hot. That goes without saying. In November, year-over-year nominal house price appreciation reached 21.5%, the sixth consecutive month it has set a new record. When measuring housing affordability based on changes in income, interest rates, and nominal house prices, we saw affordability decline about 21% compared to a year ago. The truth is that affordability is likely to decline further in 2022 because both mortgage rates and nominal house prices are expected to rise. But if you feel ready to buy a home, you shouldn't let fear stand in your way, we still need to try our best in a hot market.

As rates continue to go up, you need to be prepared as a homeowner. Here are some of the most important things you can expect (and prepare for) while entering the housing market in Spring 2022:

The Truth About Rates Increasing.

First, let's understand WHY rates are increasing. As a response to rising inflation and higher employment, the Federal Reserve has announced that the end of the easy money era is near. They are expected to increase rates as soon as March, and typically, mortgage rates follow the same path as long-term bond yields, which are expected to increase.

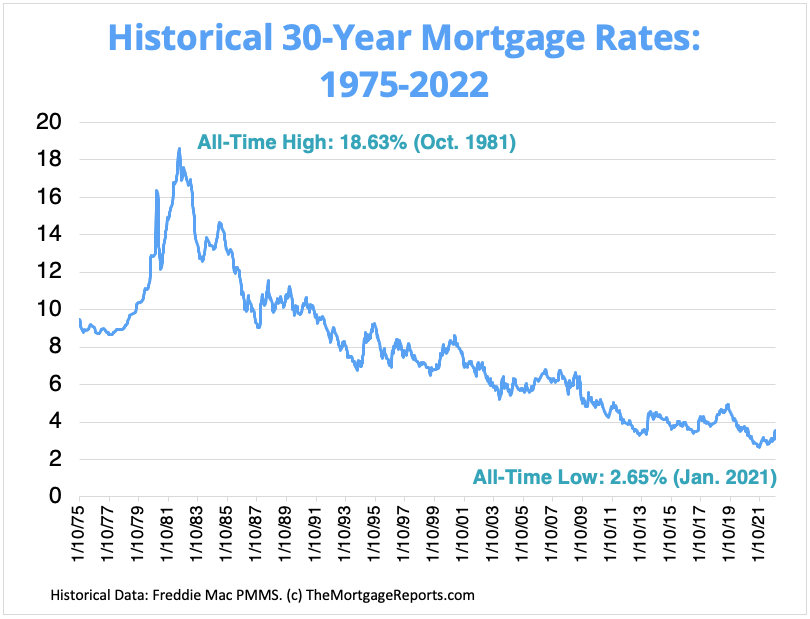

Economists are predicting that the 30-year, fixed mortgage rate will increase from its November rate of 3.1% to about 3.7% by the end of 2022, some even predicting for it to reach 4%. One thing to keep in mind however is that this is still historically low. Over the past two years, we have simply grown accustomed to lower than average rates, changing our perception of what we now consider affordable. After two years of rates around or below 3%, seeing rates above 4% may be startling for those seeking a mortgage. Rates around this level were common in the years before the pandemic, which was considered "good years" for mortgage rates.

That being said, this increase in mortgage rates shouldn't weigh too heavily on homebuyers. As a potential homebuyer, if you've decided to buy a house because of life circumstances, are you really going to let the difference between a 3.5% and a 4% mortgage rate impact that decision?

Affordability is on the Decline.

If you're in the market for a home, the difference in the increased rates can affect affordability. Aside from just increased rates, we've seen a massive surge in home prices over the last couple of years due to increased demand and lack of supply, making this quite the seller's market. Rates are rising as strong demand for homes, along with a tight supply of properties for sale, has pushed up home prices.

To quickly crackdown some numbers in terms of what we can expect from affordability, let's say the average mortgage rate remained at its current level of about 3.5% through the spring home-buying season, assuming a 5% down payment and holding average household income constant at the November 2021 level, we can expect house-buying power to fall by about $25,000. If rates increase to the anticipated end of 2022 level of 3.%, house-buying power would simply fall by more, and so on.

On a more positive note, the pace of housing price increases may slow from double- to single-digit percentages this year. This decline in the rate of increases is a good sign of economic stability coming soon. But prices are still expected to go up, and conditions will probably continue to favor sellers.

Make Sure This Is the Right Decision for YOU.

With rates increasing being top of mind, many potential home buyers may try to jump into the market now before rates rise further. The fear of missing out, or "FOMO," on low rates and the potential loss of house-buying power may supercharge the housing market ahead of the spring home-buying season. As housing supply increases in the spring months as more sellers list their homes for sale, demand may increase as well. However, you want to make sure that "FOMO" isn't the main reason you want to get into the housing market this spring.

The most important part of the home purchase process isn't the interest rates. It isn't the housing prices. It's about you. Are you ready to buy a home? The most important thing to consider when becoming a homeowner is if now is the right time for you. This is a decision that you need to make based on your lifestyle, your goals, and your current financial situation.

When it comes to comparing owning to renting, one thing to remember is that your mortgage payment will stay steady while rents keep going up. While sitting on the fence about considering owning a home vs renting, there are a few things you need to ask yourself.

- Are you ready for the responsibilities of homeownership?

- Is your credit in a good place to take out a loan?

- How much can you realistically afford?

- Do you have enough saved for a security deposit or down payment?

Finally, after considering your answers to these questions, are you ready to buy a home? If so, the first step is to research lenders and find one that you’re comfortable with. Then, before you enter the house-hunting process, getting pre-approved for a mortgage is going to make you stand out in the competitive market, allowing you to negotiate with confidence, and close the deal faster so you can make your dream of homeownership a reality.

As always, we want you to feel comfortable, confident, and knowledgeable entering the home purchase process. Whether you're a first-time homebuyer, own multiple properties, or want to refinance at a lower rate, we want to help! Take the first step and find out how much home you can afford! Visit https://wilkesmortgagegroup.com/buy/ to try out our home purchase qualifier!